I read with some amusement a student-written editorial in a campus newspaper. It deals with the issue of cutting bankers' bonuses, and its conclusion is that we shouldn't because we will lose out if we do. It makes me wonder if it's not the case that at least one of the writers is an aspiring banker.

I call into question the article's portrayal of a symbiotic relationship between bankers and society. Yes, they generate income, provide capital that ultimately creates jobs and etc. But this is a bit like saying you need your abusive husband because he earns money. Sometimes, you have to weigh whether the abuse you get is better than being independent, though no doubt the latter will be hard.

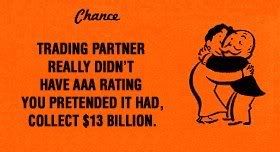

I say this because of two fundamental problems with bankers and their performance. First, there is no balance between risk and reward. Everybody wins when the times are good, especially bankers, with their large bonuses. However, when things take a turn for the worse because of the latter's decisions, society is left to foot the bill. Sure, plenty of bankers lost their jobs, but that's after they have profited massively from the bubbles they created. Besides, many others who were not in the driver's seat of crisis creation also lost their jobs. Is it surprising that people are angry, especially when the bankers want to keep their bonuses despite all this?

And aren't the trillions that taxpayers have spent to bailout the banks a good enough demonstration of a lopsided relationship? Privatising the gains and socialising the losses – that's a good description of current practice.

Second, bankers' performance is overrated. The article says that bonuses "should be directly linked to a bankers’ long-term performance and should not reward reckless risk taking". But the point is that's not how they work. Bankers are rewarded for the right results regardless of whether they did it right. They get the money as soon as they show that they are turning a profit. The large bonuses are not given only after they can show many years of consistent results, the ultimate proof of good performance. That wouldn't be something the bankers want either, and hence they would also quit. Thus, the article's call for not cutting bankers’ bonuses can only mean one thing, and that is the continuation of a broken system.

The conclusion that I draw is therefore very different: We should cut their bonuses until the bankers have something to show for them. Otherwise, all we are doing is incentivising bad behaviour. It might be hard to cut a hand off, but we should if it turns out to be gangrenous.

(0) Comments

Post a Comment